2022-05-19 13:22:52财富资讯

Currently:

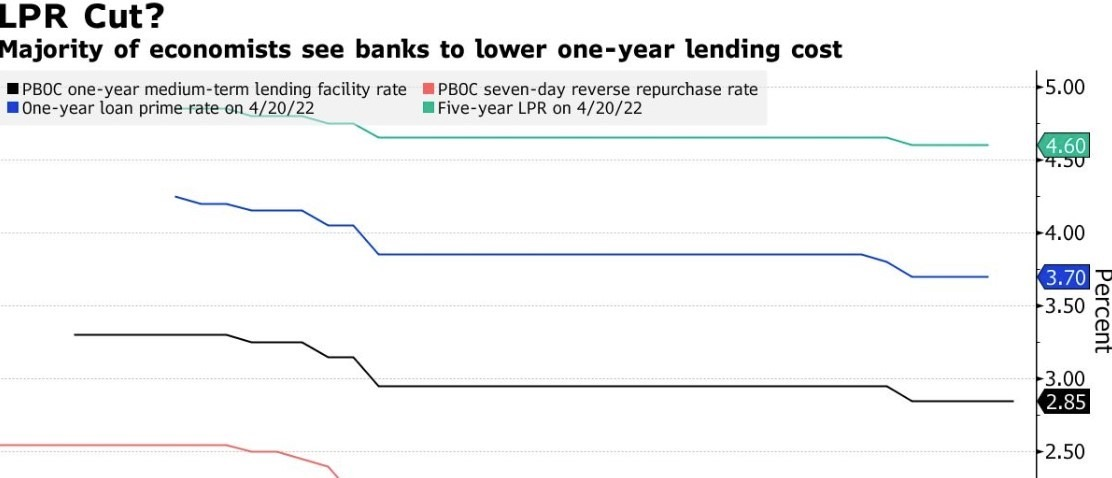

The LPRs are benchmark lending rates, set on the 20th of each month. 18 commercial banks in China submit their proposed rates to the People's Bank of China. The LPRs are based on the current rate charged for the PBOC Medium-term Lending Facility (MLF). The most recent MLF was set at an unchanged rate. The LPRs were last cut in January this year.

Once again today, consensus expectations (I've seen surveys suggesting 18 of 28 analysts expect a cut today) are for LPR cuts. This is despite the MLF rate remaining unchanged in May. Analysts that expecting a cut base thier hopes on falling banks' funding costs and also PBOC assurances of more supportinve policy to come.

The People’s Bank of China set their one- and five-year loan prime rates today. Despite there not having been any change to the Medium-term Lending Facility (MLF) rate this month the Bank cut the 5-year from 4.6% to 4.45%, leaving the 1-year unchanged at 3.7%. The 5-year LPR is the reference rate used for home mortgages in China. Lowering it is a policy move from the PBOC to assist in lowering home-loan borrowing costs and therefore prompt more economic activity. Lockdowns in China have strained economic growth in the country.